Investing Psychology

You Invest Every Day

- The simple power of investing

- The simple power of investing

The real question you should ask yourself is, "What am I investing in right now?"

Because you already are, even if you've never bought a single stock.

Every time you check your phone, you're investing attention. Every purchase you justify as "cheap" is an investment of capital. Every choice to delay, avoid, or second-guess is an allocation of energy, time, and opportunity.

You're already investing.

The only question is what's the return?

The Opportunity Cost of Everything

Let's be clear: what you do with your money is your business!

Vacations, gadgets, dinners, gifts—they all have value beyond the spreadsheet. But it helps to understand what those choices also represent.

Because a $4,000 vacation on a credit card isn't just a vacation…

It's also:

- $6,000+ with interest if carried over 2 years at 24% APR

- $44,000+ in lost investment growth over 30 years (at 7%)

- A year of future flexibility… spent today

None of this means don't live comfortably and deliciously, it just means: travel with eyes open.

Every dollar you spend has two lives: the one it lives now, and the one it could've lived more productively, and that's the essence of opportunity cost. If you ignore the tradeoff, you're making a decision you didn't know you made.

A mental exercise for identifying opportunity cost in real life

You don’t need to check CNBC or analyze balance sheets to start thinking like an investor.

You just need to practice seeing the invisible tradeoffs behind your daily choices.

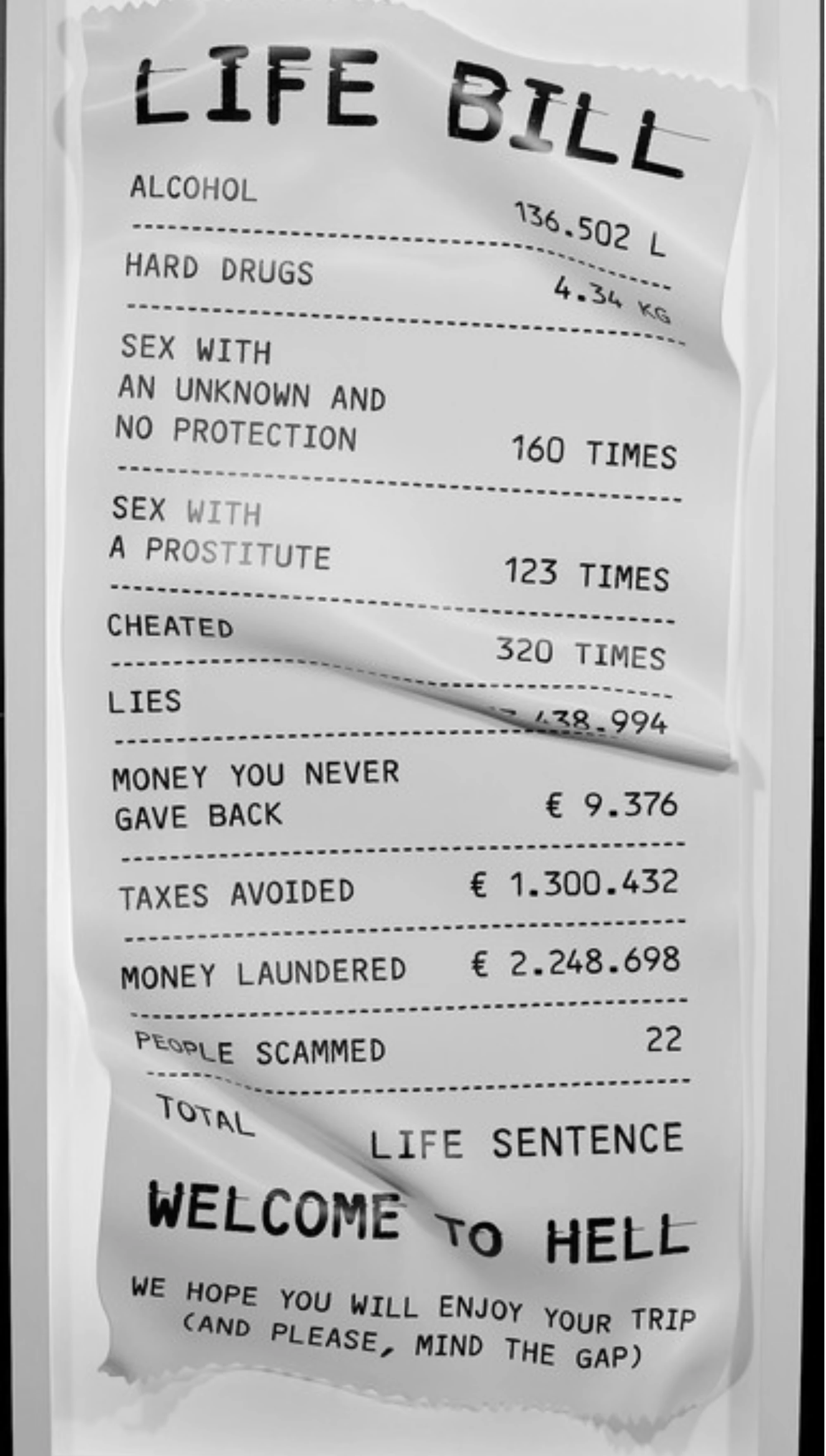

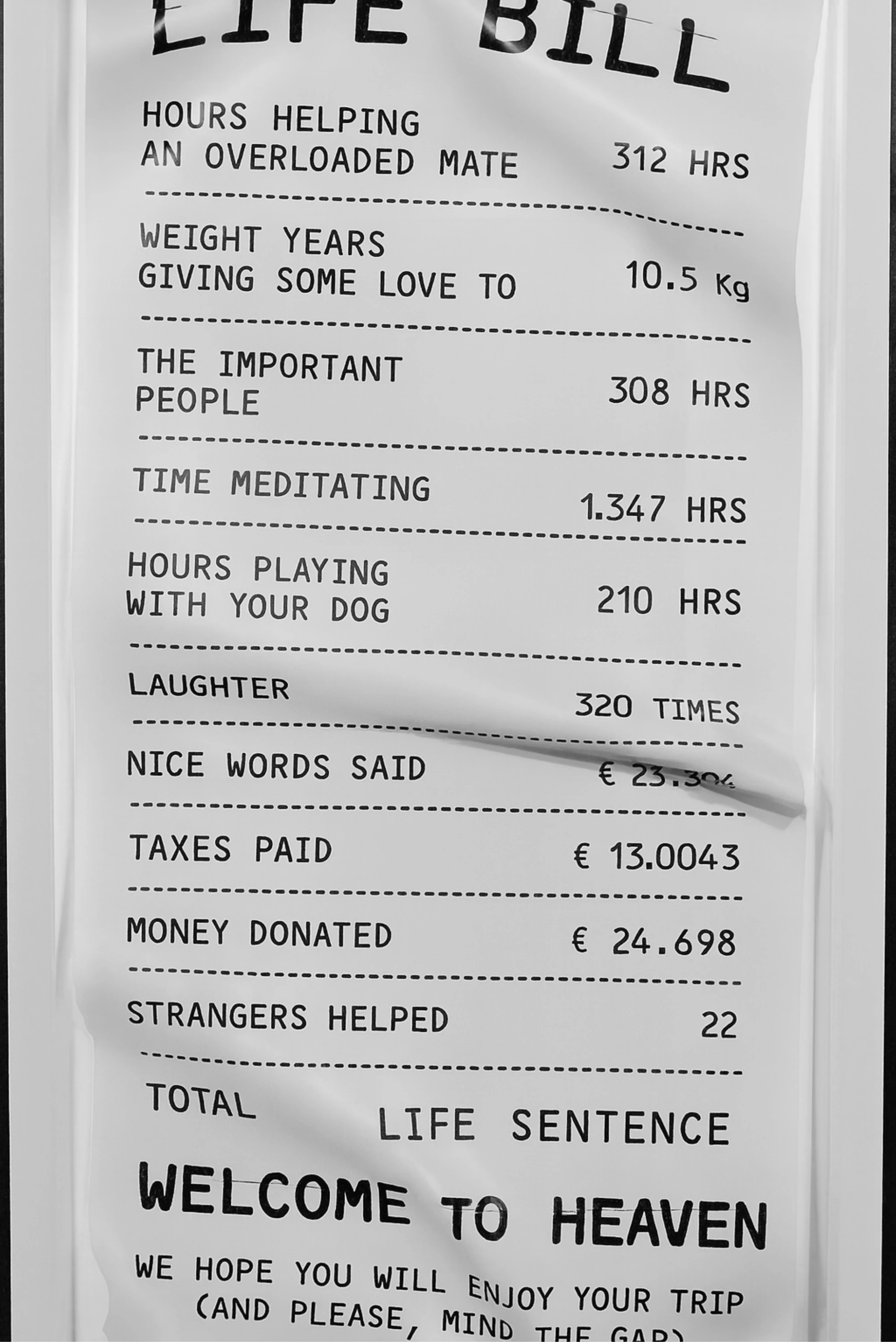

💡 The “Second Receipt” Exercise

For the next week, every time you spend money on something non-essential pause for 5 seconds and ask:

"What did I just buy instead of this money growing?"

Then mentally issue yourself a second receipt.

- $80 dinner → $800 less wealth in 20 years (assuming a 7% return)

- $300 impulse buy → 3 fewer shares in the global economy

- Cashing out your investments early → Financial freedom delayed by x years.

None of this means you shouldn’t spend, but instead, spend with clarity and purpose…