Investing Psychology

Wealth Isn’t an Information Problem

- You know everything already

- Your brain says no anyway

People often blame their lack of wealth on a lack of information, as if they're one PDF away from financial freedom. That's comforting, but it's also false.

In a 2023 FINRA study, 71% of U.S. adults scored above 50% on basic financial literacy, but only 33% had non-retirement investments, and almost half didn't have $500 for an emergency.

The problem isn't knowledge. It's follow-through.

In fact, we're the most over-informed generation in history. If you're reading this, you already have more money-building knowledge at your fingertips than John D. Rockefeller (the world's first billionaire) had access to in his entire life.

Ask most people how to build long-term wealth, and they'll give you some version of the same playbook:

This isn't arcane knowledge...

In fact, multiple large-scale studies show that financial education has only modest effects on behavior unless paired with changes in incentives or systems (Fernandes, Lynch, Netemeyer – Management Science, 2014).

Thus, most people read that playbook, and still walk away convinced someone's hiding the real answer.

Why?

Because in an age of:

- Index funds available in two clicks

- Financial calculators that simulate your entire retirement

- YouTube videos that break down every asset class

- Economic data feeds updating by the second

- Robo-advisors offering algorithmic portfolios

- And 6 billion Google results for "how to build wealth"

The boring and the proven answer, starts to feel fake.

And here's what makes simplicity even harder...

The Psychologically Unrewarding Path

To let compounding work, you have to tolerate three things most people can't stand:

- Restraint

- Delay

- No immediate hit of reward, status, or certainty

But modern life is engineered to obliterate all three.

- Dopamine on-demand through notifications, scrolls, and likes

- Social platforms that monetize urgency, envy, and self-comparison

- Consumption as personal branding

- News cycles that trigger instinct, not perspective

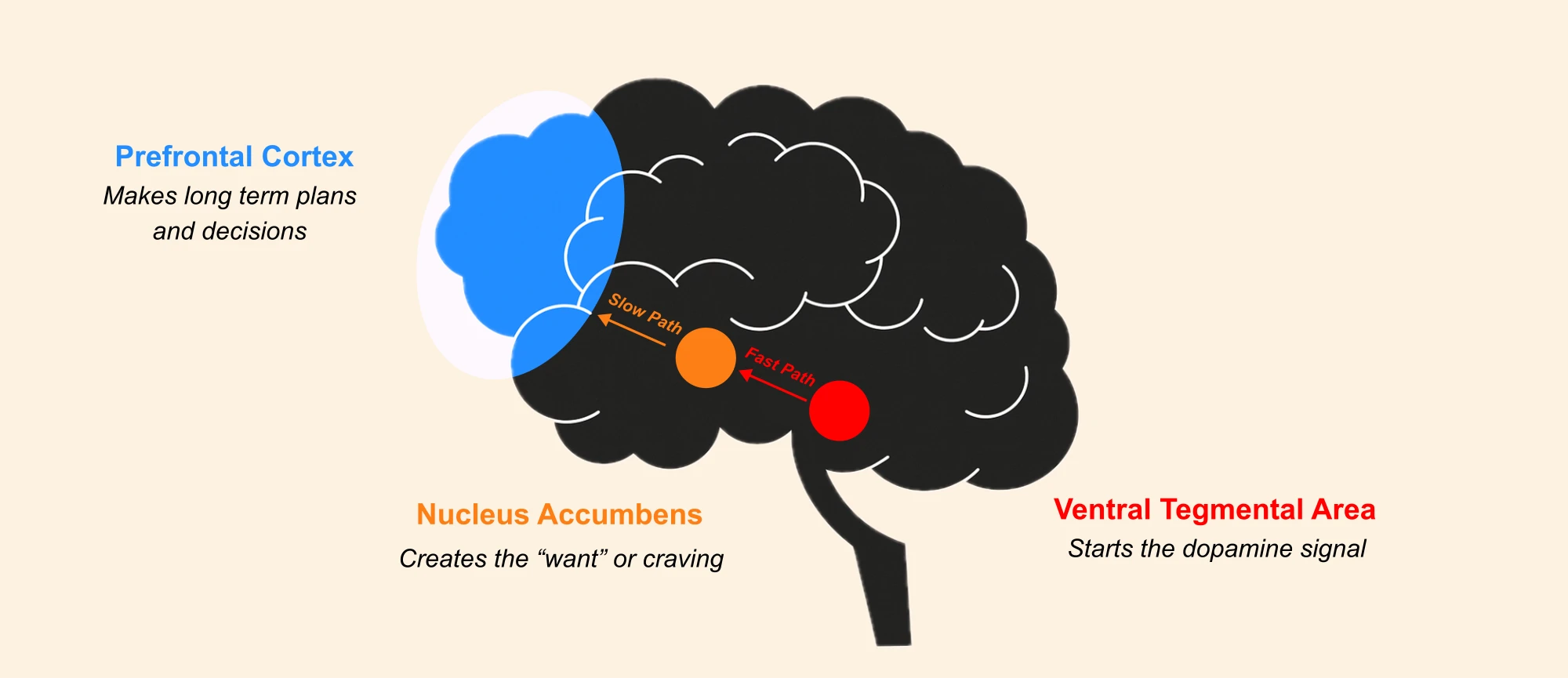

💭 Dopamine Pathways in Goal-Directed Behavior

Neuroscience confirms, the brain's dopamine system evolved for short-term survival, not long-term patience.

In behavioral studies, immediate rewards activate stronger neural responses than future ones, even if the future reward is larger.

This is called temporal discounting. And it's why checking your phone feels better than buying ETFs. It's not just discipline you're fighting, but also your biology.

Let's see what can be done about it in the next lesson.