Investing 101

Managing Risk

- Where risk comes from

- Three questions to ask

- Simple exercise

#1 Where Will My Earnings Come From?

Every legitimate investment creates value in one of three ways:

- Ownership (Stocks): You share in a company's profits and productivity.

Since 1900, U.S. equities have delivered roughly 6.4% real annual returns* - Lending (Bonds): You earn interest in exchange for lending money. Long-term U.S. Treasuries returned about 2.0% real per year over the same period. Historical data shows intermediate-term government bonds averaged 5.2% nominal returns since 1926, with inflation-adjusted returns of approximately 2.1%

- Rent (Real Assets): You receive ongoing income from providing useful assets, such as property or infrastructure.

If your profit depends entirely on someone else paying a higher price later, with no underlying income or productivity, you're not investing, you're speculating.

This is one of the key criticisms of Bitcoin and other purely price-based assets ⚠️

They generate no internal cash flow or dividends. Their value depends solely on what others are willing to pay next. That doesn't mean Bitcoin has no purpose or future value, but it behaves differently from a productive investment. It belongs in the high-risk bucket, and only after you've built a solid portfolio first.

Rule #1 of risk management: You should be able to explain why your investment will generate a return for you.

#2 What Can I Control?

Markets are unpredictable, but three variables are always within your control:

1. Costs

Fees and taxes compound against you the same way returns compound for you.

Morningstar's 2024 study found that the cheapest 25% of U.S. index funds outperformed 93% of higher-cost ones over 10 years.

Put simply: if you invest $10,000 a year for 20 years, a 1% annual fee might leave you with about $56,000 less than a fund charging 0.2%, because fees don't just subtract money, they also cut into your future compounding growth every year.

2. Behavior

Most investors earn less than their own investments, not because they picked bad Apples, but because they buy high and sell low = speculating.

Dalbar's 2023 report found that equity investors lagged the market by 1.7 percentage points per year over 20 years, purely from bad timing.

Morningstar's Mind the Gap study found the same thing: over the 10 years ending 2022, fund investors earned 1.7% less per year than their funds actually produced.

That behavior gap cost the average investor about 22% of their potential returns.

3. Time horizon

The longer you stay invested, the lower your odds of losing money.

Since 1926, S&P 500 data show one-year returns have swung from –43% to +54%, but over any 20-year period, the market has always ended positive.

In other words, time in the market beats timing the market, 100% of the time.

#3 What's The Worst That Could Happen?

Markets crash and recessions happen, but a sound investment plan survives both.

Ask yourself: If this investment fell 30%, what would I do?

If the answer is "sell immediately," your position size is too large, your horizon too short or you are investing in something you don't understand. (Rule #1)

If you could hold or add more, your risk level and approach is appropriate.

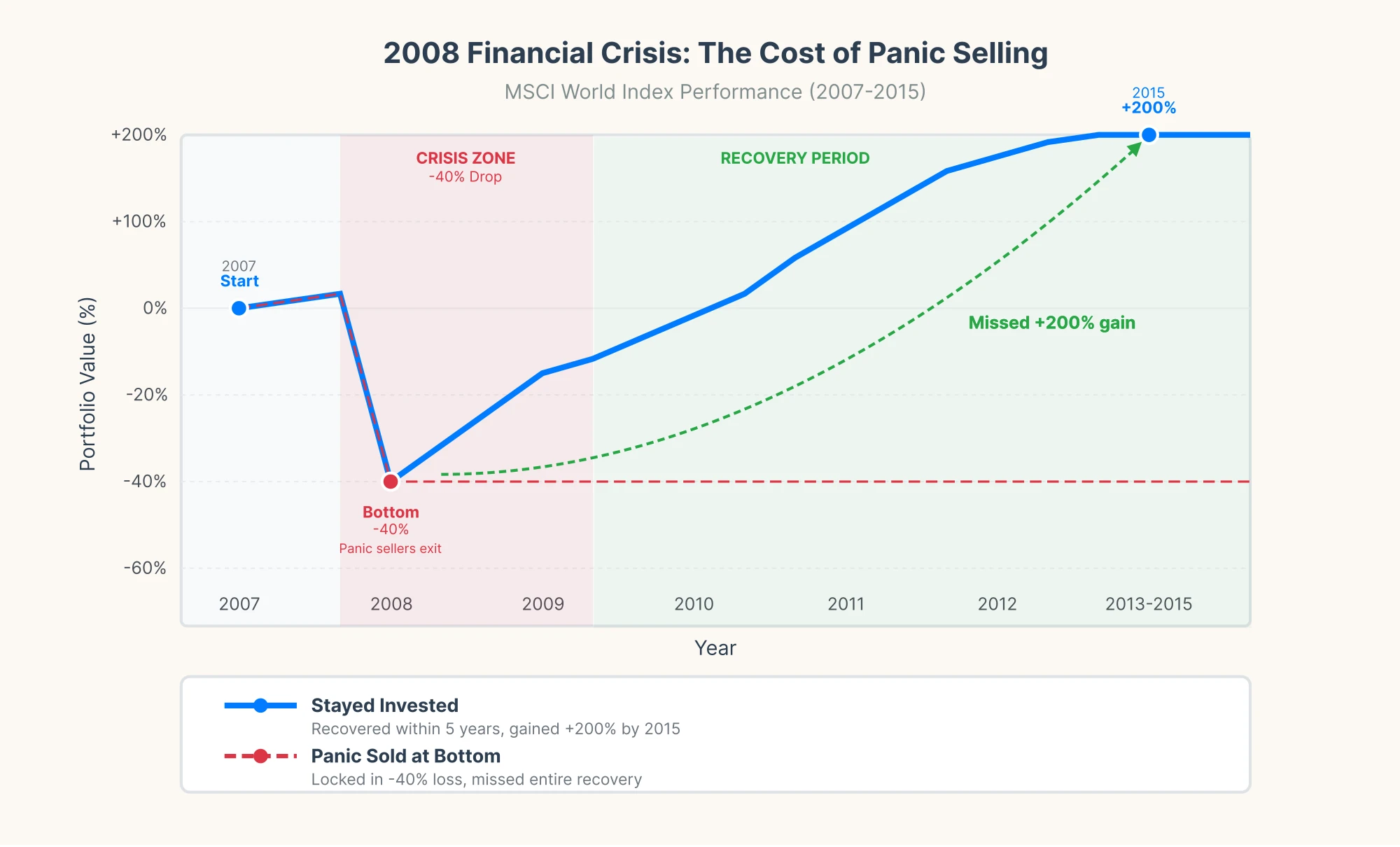

In 2008, global equities dropped around 40%. The MSCI World Index declined 40.71% that year.

Investors who held through the decline recovered within five years. Those who sold early often missed the subsequent recovery, with the MSCI World Index experiencing a 250% increase during the post-2008 recovery period and markets achieving new cycle records by 2013.

Homework: Try Thinking Like a Smart Investor

Think of one investment you've considered, anything where you expect a return: a stock like Apple, a rental property, a piece of art, a rare LEGO set, or even a friend's startup idea.

Now try to answer these three questions:

- Where will my profit come from?

- What can I control?

- What's the worst case scenario?

If you can define all three clearly and still feel confident putting money in, you're investing, not guessing.