Investing 101

Portfolio Preparation

- Understand your position

- Choose safety and trust

- Pick your why

Once you understand risk, the next step isn't picking stocks or timing markets, it's preparing your foundation.

Portfolio preparation means three things:

- Knowing if you're ready to invest.

- Choosing where your money will live.

- Defining what you're investing for.

Without those, even the best portfolio won't last through real-life volatility.

#1 Readiness to Invest

Before you put money into markets, make sure your financial base can absorb surprises.Investing is long-term by design. You don't want to sell good assets just because your car broke down or your job situation changed. Start with a few practical questions for yourself:

- Do I have high-interest debt? ⚠️

Credit card debt, for example, often costs 18–26% per year, far more than the stock market's long-term average return of 8–10%. Paying that off first is almost always a better "investment".

- Do I have an emergency fund? ⚠️

Most financial planners suggest 3–6 months of expenses in cash or a high-yield savings account. The exact number doesn't matter as much as knowing you can handle an unexpected expense without selling investments.

- Do I have a stable source of income?✅

Stability matters more than salary size. A teacher, nurse, or technician with consistent income is in a better position to invest than a freelancer with fluctuating cash flow.

Once those boxes are ticked, the only remaining question is:

"What can I reasonably set aside each month?"

A consistent $50 monthly investment compounds to more than $55,000 over 30 years at a 7% annual return.

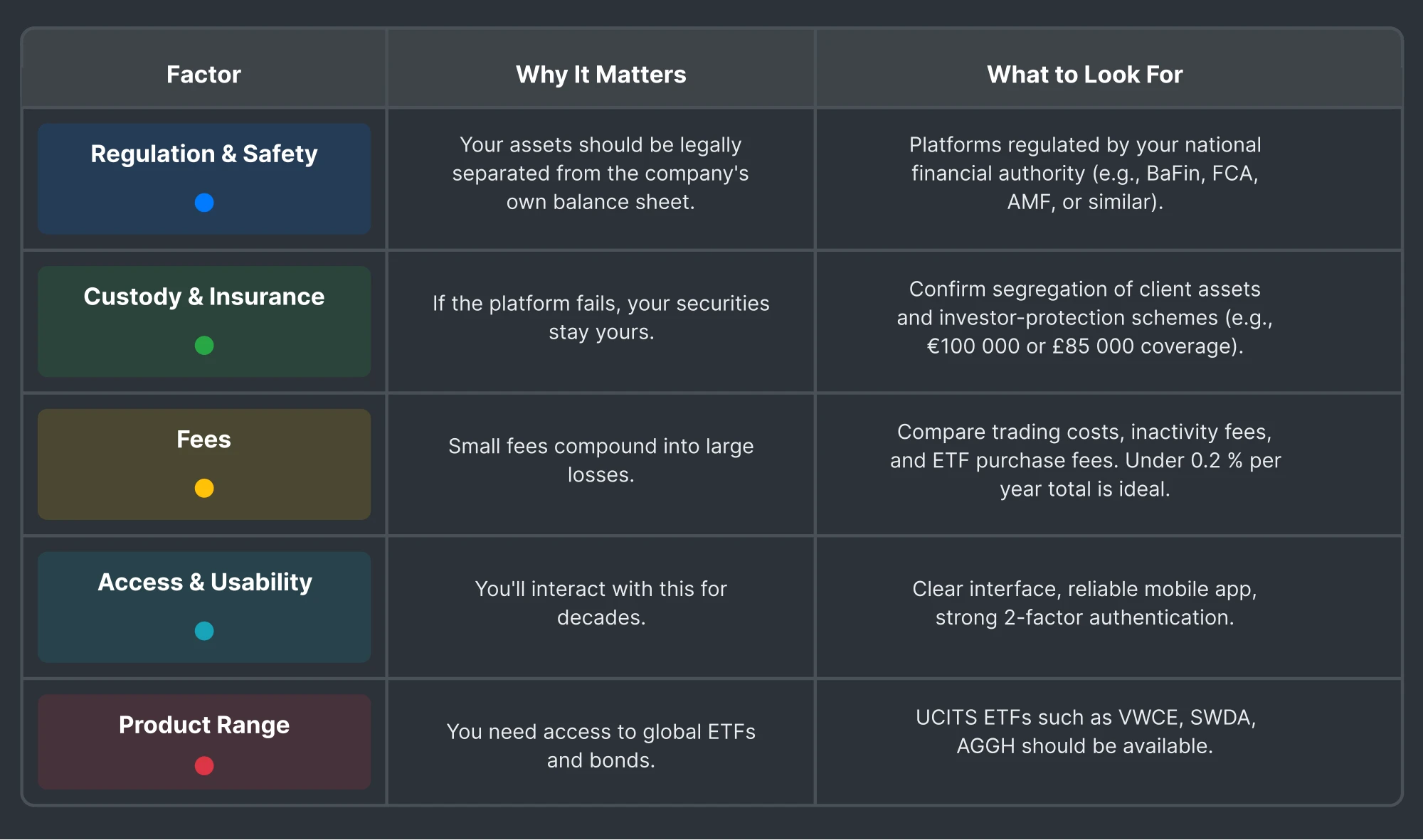

#2 Where Your Money Will Live = The Broker

A lot of beginners think of a broker as just the place that charges €22 ≡ $67 "to buy stocks."

But you should really be thinking long-term: you're trusting this platform to hold $500,000+ when your portfolio eventually grows.

New investors also get distracted by free-stock promos, flashy influencer endorsements, or aggressive advertising. Ironically, the most reliable platforms are often the ones you've never heard of, or the long-established brokerage arms of local banks.

A great global example is Interactive Brokers(IBKR)

It's been around since 1978, is a publicly traded company, and has survived every market crash since, that's the kind of track record you want.

For most investors around the world, IBKR is the safest and most trusted platform to start with.

That said, in some edge cases, there are alternatives for certain types of investors. Regulations, account types, and tax rules can vary a lot by country, we'll break all that down in the Platform Guide for your specific region.

#3 Setting Goals and Having a Why

You don't need to know every number on a spreadsheet, but you do need a clear reason for investing. Money without a purpose rarely stays invested when markets fall.

Common goals include:

- Retirement: Building long-term financial independence.

- Home or education: Planning for large predictable expenses.

- Financial freedom: The ability to live on investment income without relying on work.

Even broad goals work better than none, they give context to your time horizon and risk level.

👉 The Psychology of Goals

Setting specific goals triggers measurable motivation.

Studies in behavioral finance show that defined outcomes activate dopamine pathways, improving follow-through.

In plain terms: when your brain can visualize what "success" looks like, you're less likely to abandon the plan halfway.

Try writing a one-sentence goal:

"I'm investing $200 a month for 20 years so my daughter can attend university without debt."

That sentence becomes your benchmark for every financial decision.

Action Steps For Ready Investors

#1 Figure out how much money you can reasonably invest each month. ✅

It doesn't have to be large, it just has to be consistent.

#2 Open a brokerage account with IBKR or another reputable, regulated platform ✅

Verify your identity and complete the setup process, it can take a few days.

#3 Define your personal "why" for investing ✅

It should be clear, long-term, and meaningful enough to keep you focused when the market tests your patience.