Investing 101

Your First Investment

- What to invest in

- Why deviation doesn't work

- Your next steps

Bankers and brokers often make investing sound complicated, because complexity sells.

The harder it seems, the more likely you'll pay for products, advice, or trading that benefits them through commissions and fees. We've done the homework so you don't have to.

This guide simplifies the process into a structure that works for most long-term investors — reliably and practically.

But before we continue, remember:

This is not financial advice. Investing always carries risk, and you should consult a certified investment professional before making financial decisions.

The Idea: Own the Whole Market

Most professionals agree that for most people, the total market portfolio, owning a small slice of nearly every major company and bond in the world, is the most efficient starting point.

These assets have mechanisms in place that promote long-term stability and growth.

It captures global growth without requiring you to predict which country, company, or sector will outperform next.

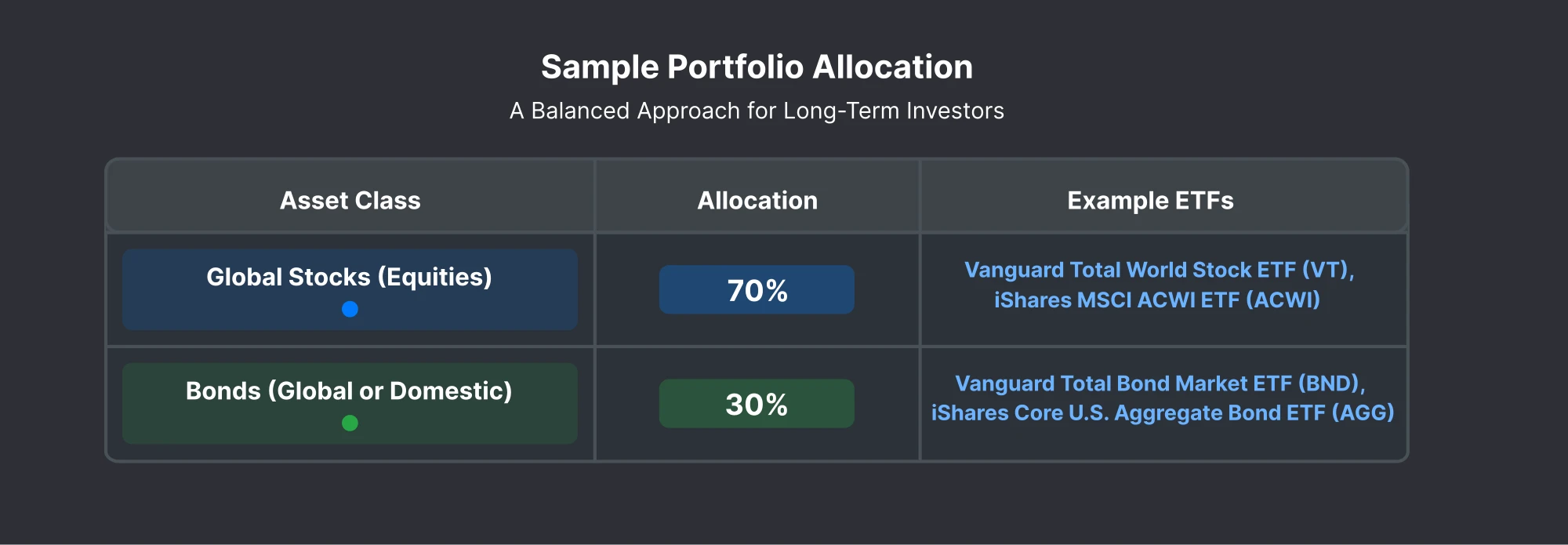

A simple starting structure might look like this:

Historically, this balanced portfolio returned about 7–8% per year before inflation between 1990 and 2023 (Vanguard data), with volatility that most investors can realistically endure.

It's globally diversified, low-cost, and requires almost no maintenance.

You can click on the ETF's in the table to explore what they consist of and where exactly your money will be invested in.

Why Picking Winners Doesn't Work

Many people think investing means picking the next Apple, Tesla, or Amazon before everyone else does.

They imagine themselves outsmarting Wall Street, finding hidden gems, and watching their portfolio skyrocket.

Here's the uncomfortable truth:

Even professional investors—people who do this full-time, with teams of analysts and mountains of data—struggle to consistently beat the market.

According to research from SPIVA (S&P Indices Versus Active), over 90% of actively managed funds underperform their benchmark index over 15-year periods.

If the pros can't do it reliably, what makes you think you can?

The problem isn't just skill—it's math.

When you try to pick winners, you're competing against:

- Hedge funds with billion-dollar research budgets

- Algorithmic trading systems that react in milliseconds

- Insiders with information you'll never have

- Your own emotions (fear, greed, overconfidence)

You might get lucky once or twice. You might even have a great year. But over time, the odds are stacked against you.

The total market approach sidesteps this entirely.

Instead of trying to beat everyone else, you join them. You own a piece of the entire market, so when the economy grows, you grow with it.

No guessing. No stress. No trying to outsmart the system.

Most beginners at this point think: is that really it? surely it can't be that simple? if it's easy, there's no chance it actually works...

And then they try to beat the market by choosing "hot" stocks or "booming" industries they read on the news, instead of sticking to the simple ETF plan above.

History (and data) show how rarely that works.

- SPIVA 2024: 86% of U.S. active fund managers underperformed their benchmarks over 10 years.

- Buffett's automobile example: In 1930, the U.S. had over 2,000 car manufacturers. By 1970, only a few remained. Even guessing the right industry didn't mean you'd guess the right company.

- Emerging markets: Over the past decade, the MSCI Emerging Markets Index saw earnings per share grow slower than GDP due to shareholder dilution and weaker governance.

The pattern is consistent: even skilled investors struggle to identify future winners.

The market portfolio avoids that problem, it simply owns them all.

Making Your First Investment

#1 Decide on an allocation.

The 70/30 mix is a solid starting point, but later on you will learn to adjust this depending on age, risk tolerance, and time horizon.

#2 Buy one stock ETF and one bond ETF.

Search the tickers (VT, ACWI, BND, AGG, etc.) inside your brokerage account.

Purchase according to your target percentages. Use "market" or "limit" orders. It doesn't matter much at this stage.

#3 Automate contributions.

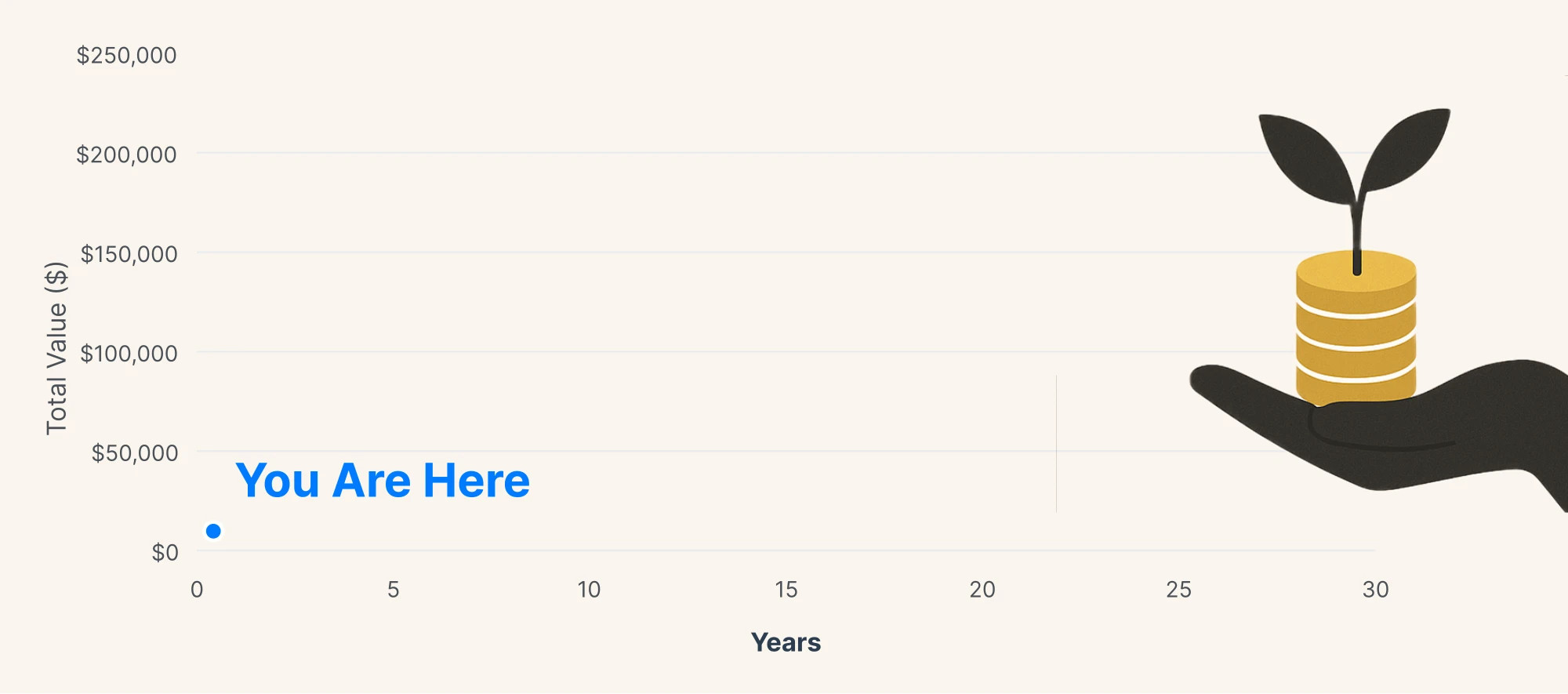

Set a recurring deposit for the amount you decided in the previous lesson and stay consistent. It's the only way to kickstart the magic of compound interest later on.

Congratulations, You're an Investor 👏

That's it. You've just taken one of the most important financial steps of your life.

You're no longer someone who "wants to invest someday." You're an investor.

And the best part? You didn't need to be rich, brilliant, or lucky to get here. You just needed to start.

From here, the strategy is simple:

- Keep contributing regularly

- Don't panic when markets drop (they will)

- Rebalance once a year if needed

- Stay patient

Remember Ronald Read? The janitor who built an $8 million fortune?

He didn't do it by timing the market, picking hot stocks, or making genius trades.

He did it by staying consistent, thinking long-term, and never giving up.

You can do the same.

Welcome to the investing world. You're going to do great.

Your money is now part of the global economy, earning returns alongside every major company in the world.

You also have something in common with the top entrepreneurs, CEO's, and even Michael Jordan.

They all invest their money 💸

From here, the focus shifts from "what to buy" to "how to behave."

In the next lessons, we'll explore portfolio management, rebalancing, and investor psychology, the habits that turn your first investment into long-term financial progress.

You'll go from beginner, to confident investor, ready for every market situation.