Investing 101

How Investing Works

- What is investing

- Compounding

- Risks

Let's finish the story we started.

Ronald Read didn't win the lottery. He didn't start a company. He didn't flip real estate or cash out a trust fund.

He saved, and what he saved he invested.

Quietly. Patiently. For decades.

Ronald bought shares in companies he believed in: blue-chip stocks like AT&T, General Electric, and Procter & Gamble. He held onto them, reinvested the dividends, and let time do the heavy lifting.

He understood something most people overlook: money doesn't just sit or disappear. It can work.

And just as it works for Wall Street geniuses, it can work for teachers, janitors, mechanics, students, taxi drivers, baristas, and literally anyone who can set aside a little bit each month.

So What Is Investing?

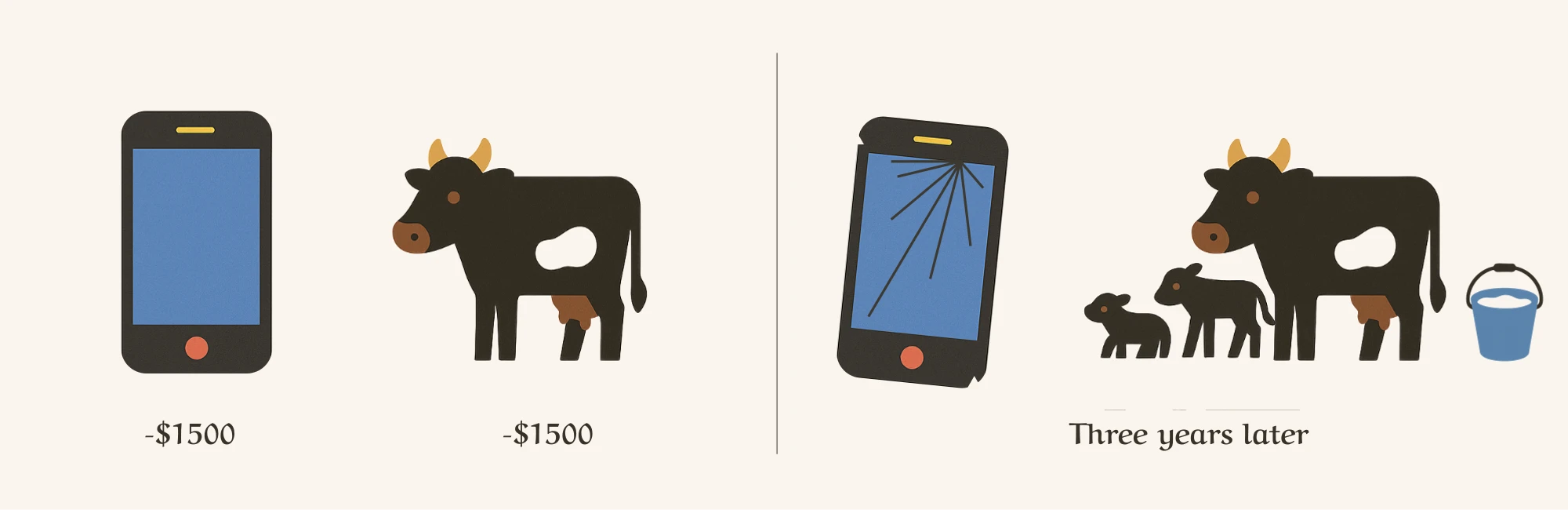

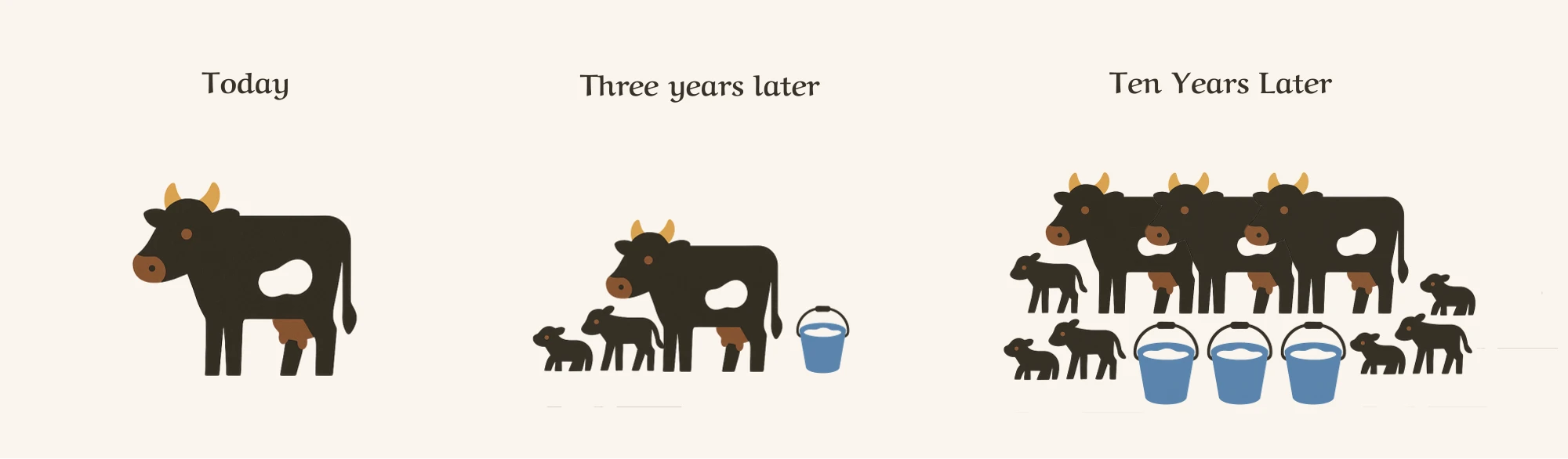

Think of it like this: You spend $1,500 on a brand-new phone. Three years later, it's scratched, outdated, and worth maybe a few hundred bucks. Now imagine spending the same $1,500 on a young dairy cow.

Three years later, it's given you plenty of dividends: milk, two calves, and it's still worth what you paid, maybe even more.

💡 That's the key difference between a purchase and an investment:

When you invest, you're putting your money into something that can grow in value, and work for you over time.

These are called assets:

- A share of a company (stock)

- A loan you give in exchange for interest (bond)

- A block of real estate

- A stake in alternative investments (mutual funds, ETFs)

Each one carries risk, but also the potential to grow.

Compounding: The Quiet Superpower

Compounding is when your money earns gains... and then those gains start earning gains, too.

Albert Einstein famously called it the "eighth wonder of the world."

But here's the catch: it starts painfully slow. So slow you'll wonder if it's even working. And then, almost invisibly, it accelerates, rewarding those who stay patient and consistent.

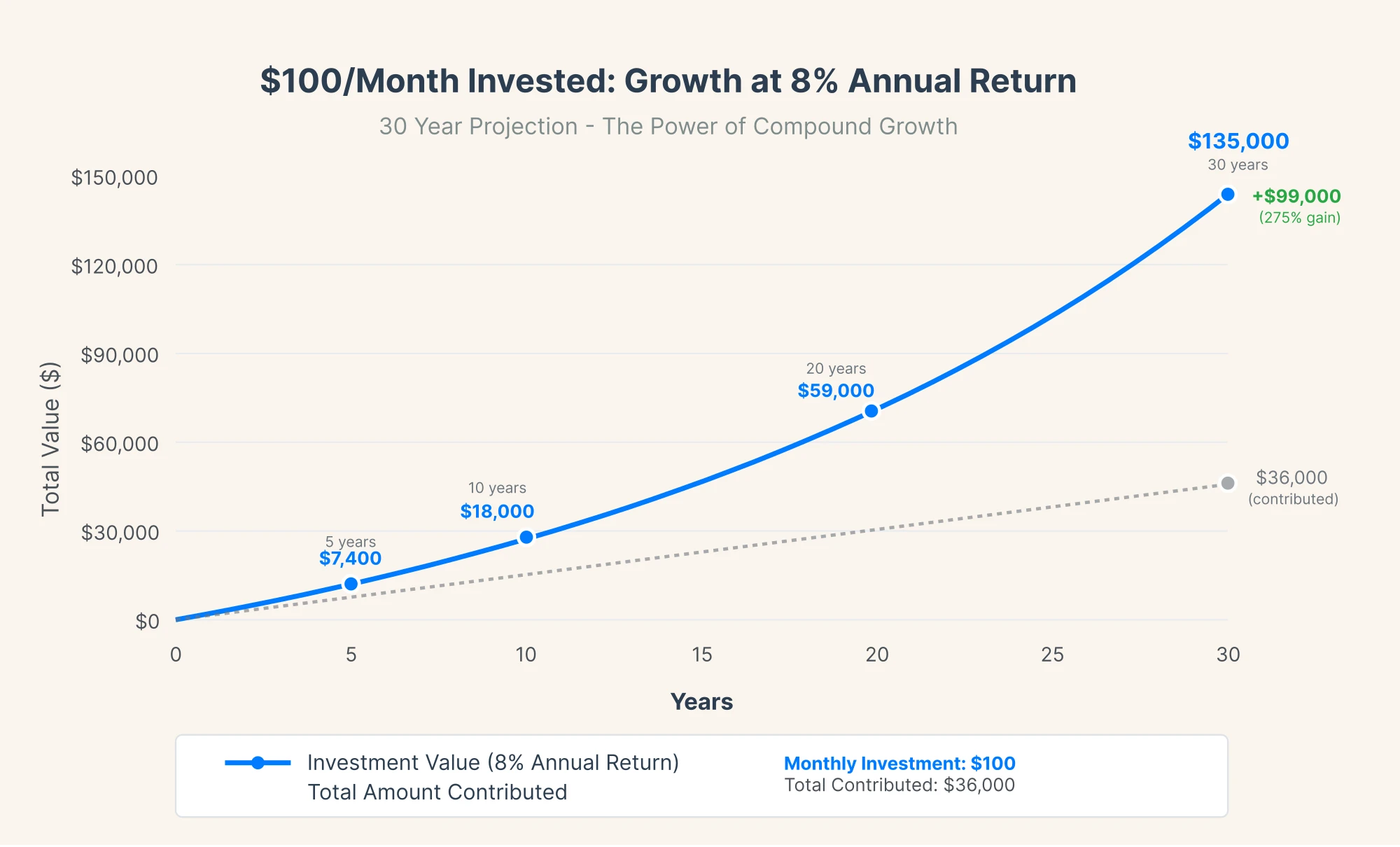

Check the math below:

It's not a perfect blueprint, because yes, inflation and market swings are real. But it shows how even small amounts, saved and invested consistently, can snowball into life-changing sums.

Just $100 a month, money many people could free up with a few small financial tweaks, can grow for beyond what feels possible today.

Now, let's address the realities.

"But Isn't It Risky?"

It is, if you treat investing like a casino, hoping your last $500 turns into millions by next week.

✗ That's gambling

Smart investing looks very different.

- Putting money into assets with built-in mechanisms for growth (more on this shortly)

- Starting early, and contributing regularly

- Ignoring the noise that makes it all seem complicated

There is still risk, even if you do everything right.

But it's not the "I lost everything in 3 days" type of risk.

It's the "I made a bad decision and might need to take a small loss to adjust" type of risk.

Smart investors don't eliminate risk, they manage it.

And there are three simple ways to do it well...