Investing Psychology

Emotional Inheritance

- Your instincts are treated as inputs

- The cost of reacting is invisible but compounding

When Daniel was eight, he watched his parents argue in the kitchen over a newspaper headline.

It was 2001. The dot-com bubble had just burst. His father said, "This is why we don't gamble with stocks."

His mother nodded, quietly folding the retirement statement like it was toxic.

No one sat Daniel down and said, "Investing is dangerous." No one had to. His nervous system took notes.

Fast-forward twenty-five years.

Daniel makes $280k as an engineer. His 401(k) is 40% cash, 30% bonds, and 30% target-date funds he barely understands. He's "waiting for the right time" to go into equities.

Every time someone mentions tech stocks, he says, "I just don't want to get burned."

Selective Perception

Selective perception is the psychological glitch that explains how pseudoscience like The Secret could sell 30 million copies, and actually feel like it works.

It's not magic. It's not manifestation. It's the brain filtering reality to prove itself right.

You've felt it:

- You go through a breakup, and suddenly every street, café, and feed is full of happy couples.

- You're thinking about buying a red Tesla, and out of nowhere, they're everywhere.

Those Teslas were always on the road. Those couples weren't summoned by heartbreak. Your attention just got hijacked.

That's selective perception: your past, and your beliefs, deciding what gets your attention and what gets erased.

Psychologists have tracked this data for decades:

- People whose parents lived through recessions invest 30–40% less in the stock market.

- First- and second-generation immigrants (no matter their income) hoard cash and real estate instead of using retirement accounts.

- Adults raised in inflation-ravaged economies overweight gold and property even when markets are stable and returns are poor.

- 70% of generational wealth disappears by the third generation, not because of spending sprees, but because of misallocation, defensive choices, and inherited fear.

The most important detail?

Nobody thinks they're doing this.

The Story of the Planes, and What You Never See

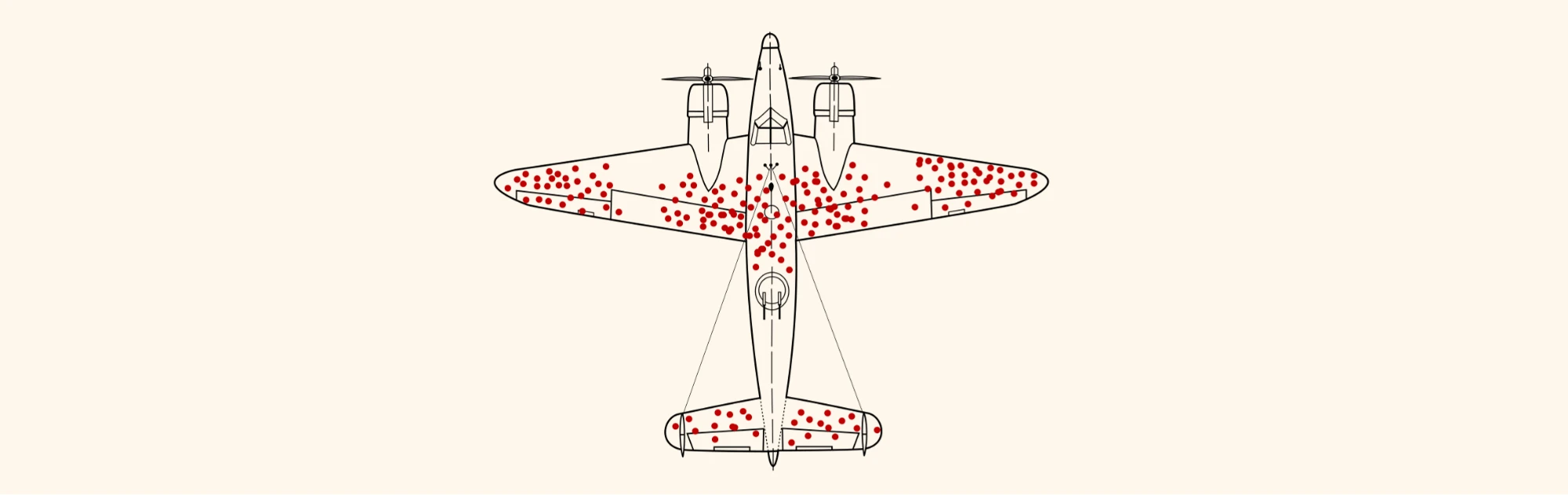

During World War II, researchers studied returning fighter planes covered in bullet holes. The military had the obvious logical plan: Those areas are taking the most shelling. Lets reinforce them. Obvious right?

But a savvy statistician Abraham Wald said:

"You're looking at the planes that survived. Reinforce where the holes aren't. That's where the fatal hits were."

That's survivorship bias: seeing only what made it through.

Investors do the same, especially when selective perception shapes what they notice.

They say:

- "Real estate never fails." (They don't see the foreclosures.)

- "Apple and Bitcoin created millionaires." (They don't see Enron, Nokia, MySpace, or the dot-com graveyard.)

- "The guy on YouTube is doing great with penny stocks" (But that's only because he shows you the winners)

Selective perception decides what even enters your awareness. Survivorship bias only completes the illusion.

Ask yourself the right question today

Selective perception is tricky, because it doesn't announce itself. It just edits reality in ways that feel reasonable. But there's a simple way to surface it without pretending you can override it in one stroke.

Ask yourself this, clearly and without branding it as intuition:

What kind of financial risk feels the most real to you?

- Losing money?

- Missing out?

- Embarrassing yourself?

- Owing someone?

Now trace that feeling back. Not in data, to exposure.

Because the risk you feel most strongly is usually the one you were raised around, not the one with the highest statistical likelihood.

Once you know where the filter comes from, you can begin question it.