Investing 101

The Basics of Money

- How real people can invest

- The pros/cons of time

- The simple power of investing

Ronald Read was a janitor and gas station attendant in Brattleboro, Vermont. A small town of about 12,000 people, the kind of place where everyone knows everyone.

When Ronald passed away in 2014 at the age of 92, the community was stunned. The friendly, frugal man had been quietly living a secret life, revealed only through his final acts of generosity.

- He left $4.8 million to the local hospital

- $1.2 million to the public library.

- In total, his estate was worth more than $8 million.

How could a man on a janitor's salary build such wealth?

Was he secretly a mogul? A crime boss? A lottery winner?

The truth is much simpler, and it holds an important lesson you'll learn here.

Why Money Matters (In case you didn't know)

Money is one of the most fundamental tools for human security. We trade our time and skills for wages, then use that money to pay for food, housing, healthcare, childcare, and everything else that helps us feel safe and stable.

In modern developed economies, it's nearly impossible to live comfortably (think anxiety-free) without money. You don't need millions, but you do need enough so that a health issue, a broken car, or a run of bad luck doesn't push you to the edge.

Unfortunately, the data is clear: income inequality is growing, and financial insecurity is rising.

💡 In 2024, 77% of U.S. adults said they are not completely financially secure.

People try to solve this problem in two obvious ways:

- Selling skills and time (working harder)

- Selling products or services at scale (taking risks in business)

Both are valid, but both are capped by limited resources: your skills, your time, your health, and your energy.

And the less money you have, the harder those resources are to stretch.

Why Saving Isn't Enough

Saving like a single mom of three, juggling every penny and two jobs, doesn't come naturally to most people. Most of us want joy in our lives. We want to buy things we enjoy, experiences we'll remember, and that toy for our kids even when it's not in the budget.

But even if you manage to save consistently, you're still battling an invisible force: inflation.

It's the byproduct of economic growth (and sometimes mismanagement), which hurts those with the least, the most.

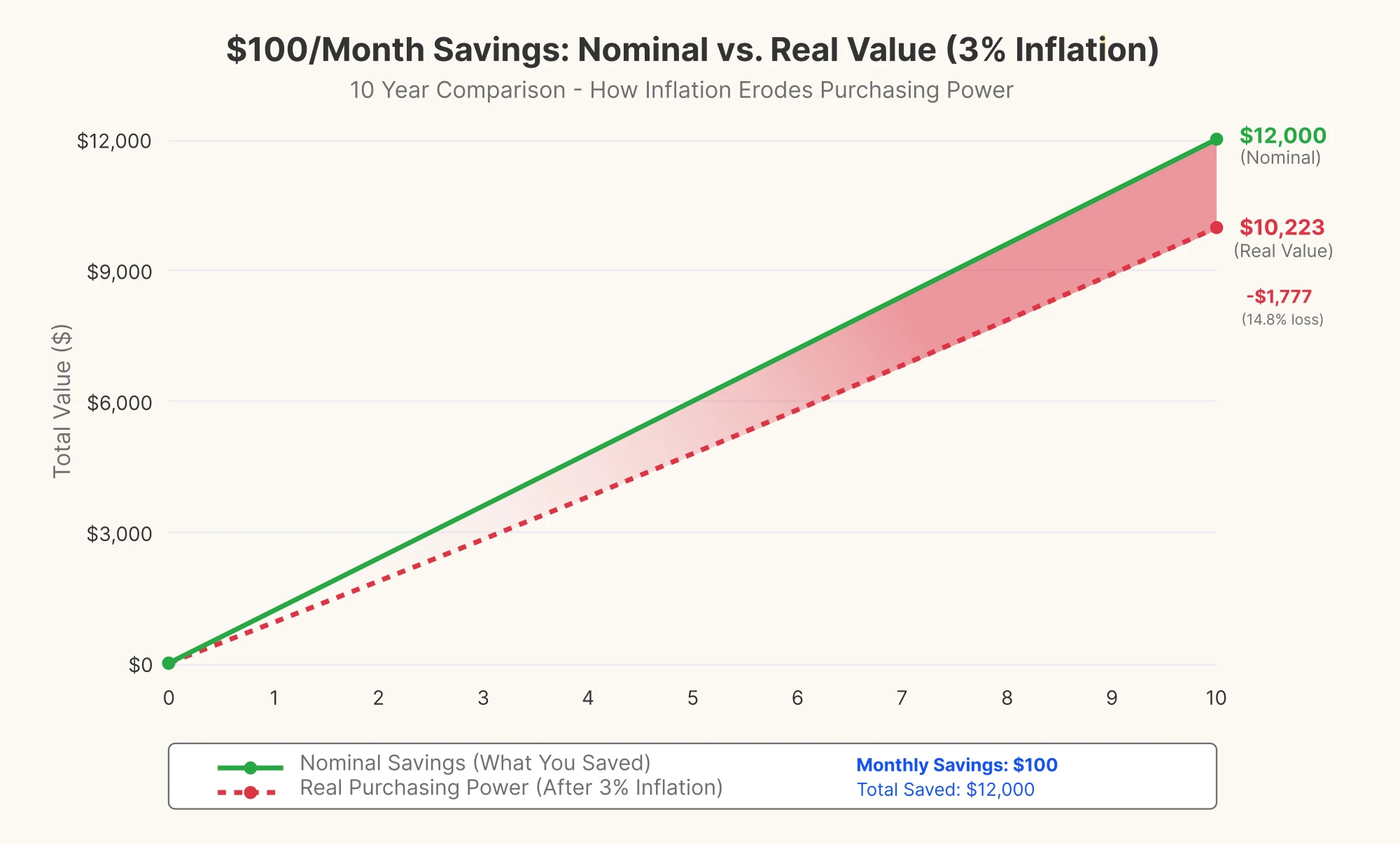

Here's the basic math of your savings at 3% inflation. (In many countries, that number is even higher.)

The lesson here is simple: saving alone is rarely enough.

It can help in an emergency or cover a short-term purchase, but it won't protect your money from inflation, and it won't increase your financial security. In the end, you're always starting back at square one, restarting the saving–sacrifice cycle until the next big purchase or emergency.

But let's be clear...

Saving is an important first step. Ronald was a diligent saver, and that habit unlocked doors most people assume are closed...

...especially for a part-time janitor whose favorite hobby was chopping wood, not chasing business ventures.

Enter Investing

Most people have the wrong ideas about investing, such as:

None of that is true. At its core, investing comes down to three things:

- Money (not as much as you think)

- Time (more than you probably think)

- Asset (something that can gain value over time)

As Ronald proved, anyone can be an investor, and a successful one at that.

In fact, you could become an investor within the next few hours. The process is simple, and the next lessons will show you exactly how.